Personal debt bonds, such bonds www.jupiter-swap.net , are traded over the counter because of the funding banking institutions. Rather than the fresh shares away from a buddies, securities aren’t in love with transfers because they can come from various other issuers totally. For each bond differs, with unique maturities, beliefs and you can credit scores. Normally, because there are so many decentralised transfers going on, it’s already been difficult to comprehend the exchange frequency that happens to the this market.

Obviously, we’re still speaking of enterprises with little to no controls. It wasn’t as easy to make sketchy works closely with noted companies, although it nevertheless took place. Remember, they’re also from-replace areas work at because of the representative-dealer networks. Within the 1999, it turned into the original company to carry electronic estimate services to help you the newest OTC segments. OTC Places Class, the biggest digital market for OTC ties, communities ties from the level based on the quality and you will quantity of information the companies report.

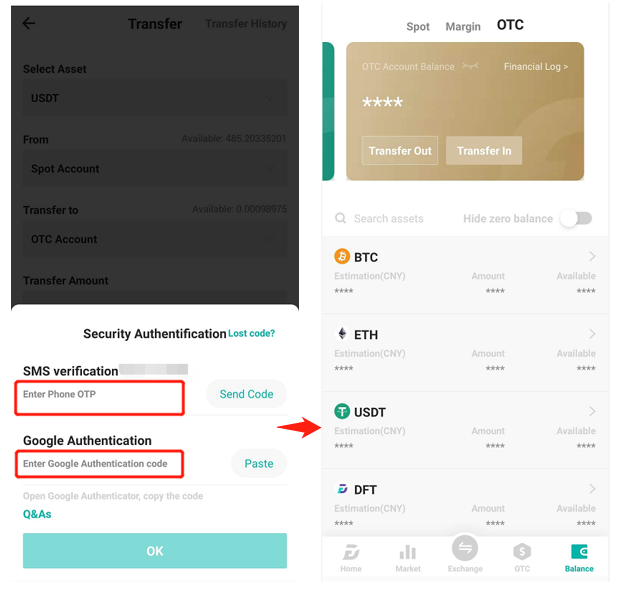

Inside the a keen OTC market, buyers play the role of business-makers by the estimating costs where they’ll trade a security, currency, or other borrowing products. A trade can be carried out ranging from a couple players inside the an enthusiastic OTC industry instead of anybody else being conscious of the purchase price from which the new purchase is actually finished. In general, OTC locations are typically smaller transparent than just exchanges and they are susceptible to fewer laws and regulations. Because of this, exchangeability in the OTC industry can come from the a premium. Brings and you will securities you to definitely trade to your OTC market are typically from reduced firms that wear’t qualify becoming noted on a major replace. Since the cryptocurrency industry continues to mature and you can attract more institutional buyers, the brand new demand for OTC trading is anticipated to grow.

This can be one to disadvantage of Forex being OTC; you to data is reduced available compared to the to your-exchange possessions. For example, while inventory volume will likely be tracked every hour or every day, more cited Fx frequency figure arises from the new triennial Main Lender Survey. That being said, there are government regulatory hoops to help you plunge as a result of.

OTC Trading within the Cryptocurrency: A thorough Book for beginners

The newest Red Sheets or Red Open-market doesn’t have minimal monetary fundamental you to companies are needed to satisfy, nor manage he’s reporting otherwise SEC registration standards. Speaking of just required in case your organization is noted on an excellent Qualified Forex. Typically, the word trading non-prescription referred to bonds changing hand ranging from a couple functions without the involvement of a stock exchange. However, in the U.S., over-the-prevent trade is now presented to the independent exchanges.

Most buyers is actually reassured by standardization and you will regulating oversight provided because of the centralized transfers. Personal deals will likely be a mass which is smaller daunting to possess the small investor. As an example, a trader having minimal investment you’ll believe mini possibilities (10 shares) for the high-listed holds in place of fundamental possibilities (one hundred offers). The new change features standardized conditions and you may demands per by-product package. A move-replaced derivative try a monetary bargain that is listed and you may traded to your a managed change. Put differently, speaking of types which can be exchanged inside the a managed environment.

Although some crypto More than-the-Avoid agents had been in operation some time ago, the picture is totally additional today. Not simply are there several crypto brokers, however, significant transfers have also hung their OTC tables to benefit from the newest digital resource circulate regarding the industry. Going by accounts, America and Asia listing the highest OTC crypto points around the world. OTC places trading a range of ties as well as carries, securities, derivatives, REITs, and ADRs.

Swiss refreshments organization Nestle (NSRGY step 1.08percent) are a good example of a major team one to positions OTC inside the the brand new You.S. The business features a good 3 hundred billion and an extended reputation of returns. Even though it’s listed on the Half a dozen Swiss Stock-exchange, the organization’s shares are just available because the ADRs through the Green Sheets regarding the U.S. To help you qualify for it tier, enterprises must satisfy high financial requirements, end up being most recent within reporting, and you will go through a yearly qualification opinion. The fresh OTCQX ‘s the premier marketplace for dependent, investor-focused U.S. and you can global enterprises. The brand new OTC Places Group operates managed places to have trade more several,one hundred thousand You.S. and you may international securities which are not listed on indicator and transfers for instance the Dow-jones or Nasdaq.

As the laws to own OTC places are reduced strict than simply big exchanges, companies do have more freedom inside the components such as revealing criteria, show rates, and you will business governance. To have buyers, it means a lot fewer limits to the trade and more opportunities to see really worth. Yet not, the reduced oversight also means much more volatility and you will suspicion. Businesses will get opt to trade shares regarding the more-the-prevent industry (meaning, it trading as a result of a brokerage-dealer) if they’re incapable of meet up with the listing conditions of a community change. OTC exchange may attract companies that had been in past times traded to the an exchange but i have because the become delisted.

Relevant Stocks

These businesses is actually most recent within revealing market shares to own at the least step 1 cent. Oversold otherwise undervalued requirements rule a good time to shop for, if you are overbought requirements suggest it may be time and energy to offer. Fool around with restrict requests to have OTC brings simply because they often feel higher spreads amongst the quote and get price. As the an investor, OTC segments expand your options by giving your use of growing growth organizations. Get a better understanding of what OTC places and you can bonds is, and factors to own including him or her in the exchange otherwise paying approach. For many who’re also looking for OTC trade, the first step would be to imagine just how much chance your’re also ready to undertake and how far money your’lso are ready to dedicate.

The businesses you to definitely matter these types of holds choose to trading like that many different reasons. Counterparty chance is an issue, while the OTC investments try used personally ranging from events. If an individual team defaults on the their debt, additional group could possibly get deal with economic loss. OTC locations and lack the visibility and you will regulatory supervision contained in exchange-traded locations.

But not, more strict laws and regulations might also perspective challenges, such as increased conformity costs. Recognizing the potential worth of this type of coins, I decided to promote her or him due to More than-the-Avoid trading. I used the Alephium Discord host, a residential area program to have Alephium fans, to get audience. After settling the price and you will terms of the brand new trading, We effectively ended up selling my personal Alephium coins (not all ;). Despite the relatively inconsistent tone, people may want to think adding BYDDF to their portfolio.

OTC Areas Classification

Manufacturers and you can customers participate in OTC investments to manage their commodity price publicity and secure also provide agreements. Investors play the role of intermediaries, facilitating purchases anywhere between consumers and you can vendors. Loan providers, such banks, render liquidity and you will help risk administration due to hedging devices.

It needs social businesses so you can declaration breaks, reverse splits, identity alter, and you may mergers. For many who view Level dos on the an OTC, you can even discover anything unusual. There’s always a vendor at the a higher rates versus latest step. Today, for those who lay an industry get buy and also you score routed to that particular broker-specialist — really, you happen to be the only delivering that offer. At that time, you could potentially get offers from your own buddy inside the a restaurant otherwise a pub.

Less Regulatory Defenses

Discussing the problem away from sourcing considerable amounts from crypto is what crypto OTC tables master. Because of him or her, you can buy your own five hundred BTC all-in-one test having no charge, and you may instead doing all legwork. To prevent slippage, you would be better off spread you buy away from five hundred BTC to multiple transfers, to purchase quicker pieces out of BTC at the best rates available on for every change. As with any other OTC locations, trading usually happens anywhere between a loyal trade “desk” and another individual or establishment, described as a great counterparty.

Alternative investments can get lack variation, involve state-of-the-art tax formations and possess waits within the revealing extremely important taxation information. With regards to OTC carries, it’s important to understand how the new advantages and you will prospective drawbacks will get balance — if. It’s and helpful to consider carefully your private chance endurance and you may financing requirements to decide when it is reasonable to participate the brand new over-the-prevent industry.